The 2026 RBI Credit Card Rules: What Every Indian Consumer Needs to Know

Published: 21/02/2026 | by Amit Sharma

Quick Summary

Under the RBI Credit Card Rules 2026, the Reserve Bank of India (RBI) is implementing sweeping credit card regulations designed to protect consumers. Key updates include a transition to weekly credit score reporting (proposed for July 2026), mandatory dynamic 2FA for digital payments by April 2026, and strict bans on charging “interest on interest” for late fees. For disciplined users, these changes mean faster credit score improvements, zero hidden billing traps, and significantly stronger protection against digital fraud.

Quick Reference Table

| RBI Regulation | Key Impact | Target Deadline |

| Dynamic 2FA | Online payments move to biometrics / secure app prompts. | April 1, 2026 |

| Weekly Credit Reporting | Credit bureaus update scores 4x a month. | July 1, 2026 (Proposed) |

| Interest Calculation | Bans compounding interest on late fees or taxes. | Active / Phasing In |

| Card Activation | Explicit OTP consent required to keep unactivated cards open. | Active |

I. Introduction: Why 2026 Is a Turning Point | RBI Credit Card Rules 2026

If you use a credit card for groceries, travel, EMIs, or monthly subscriptions, the rules of the game are fundamentally shifting. For years, consumers have had to navigate interest-on-interest debt traps, sluggish credit score updates, and vulnerable SMS-based security.

Now, the RBI Credit Card Rules 2026 are tightening the ecosystem to favor disciplined users. The central bank is focusing on three core objectives:

- Stronger Digital Security: Moving away from vulnerable SMS OTPs.

- Zero Tolerance for Hidden Billing Tricks: Ending the compounding interest spiral.

- Faster Credit Reporting: Ensuring your timely payments are rewarded instantly.

II. The Shift to Weekly Credit Score Reporting

Until recently, banks reported your credit activity to bureaus like TransUnion CIBIL only once a month. The RBI has already compressed this to a 15-day cycle, but the biggest change is yet to come: according to the RBI’s draft rules for credit reporting, there is a proposal to mandate weekly updates to bureaus by July 1, 2026..

What This Means for You

If you consistently pay your bills before the due date and follow these strategies to improve your CIBIL score, your credit profile will reflect these positive behaviors within days, rather than weeks.

How to Leverage Weekly Reporting:

- Applying for a Home Loan: If you clear your outstanding balances just two weeks before a loan application, your updated, higher score will be visible to the lender immediately.

- Error Correction: Disputed errors on your report will be rectified and updated across bureaus significantly faster.

Pro Tip for Invest With Bull Readers: When We are analyzing loan trends, it’s clear that a quick 20-to-30 point score improvement right before applying can help you negotiate a lower home loan interest rate by 0.25% to 0.50%. Over a 15-year tenure, that translates to lakhs saved.

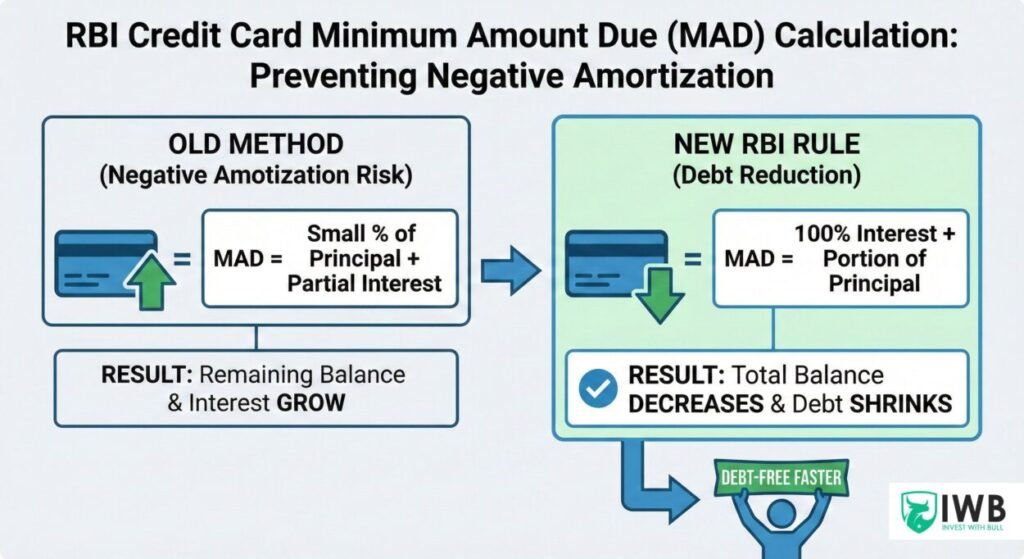

III. Billing Transparency & Fair Interest Calculation

This regulation is arguably the biggest financial win for the Indian consumer.

The End of “Interest on Interest”

Previously, if you only paid the minimum due, banks would charge interest on the remaining principal, add late fees, add GST, and then charge interest again on those newly added fees. This compounding effect created a massive credit card debt trap for many users.. Under the new rules, banks cannot capitalize late fees, taxes, or penalties. Interest applies only to the outstanding principal.

The Minimum Amount Due (MAD) Fix

Historically, the MAD was set so low that your total balance would keep increasing even if you never missed a payment. Now, when you calculate minimum amount due on a credit card, it must legally include:

- 100% of the accrued interest.

- A portion of the principal amount.

This guarantees that if you pay the minimum due, your overall debt will actually decrease, preventing negative amortization.

IV. Stricter Rules on Card Activation and Limits

The 30-Day Activation Mandate

Under the updated RBI Master Direction on Credit Cards, banks can no longer leave unactivated credit lines sitting on your credit profile.. If you receive a new card and do not activate it within 30 days, the issuer is legally required to obtain your explicit OTP consent to keep the account open. If you do not provide it, the card is automatically closed, protecting your credit utilization metrics.

Ironclad Credit Limit Protection

Automatic limit enhancements are a thing of the past. Banks cannot upgrade your card variant or increase your credit limit without your documented, explicit approval. You maintain total control over your credit exposure.

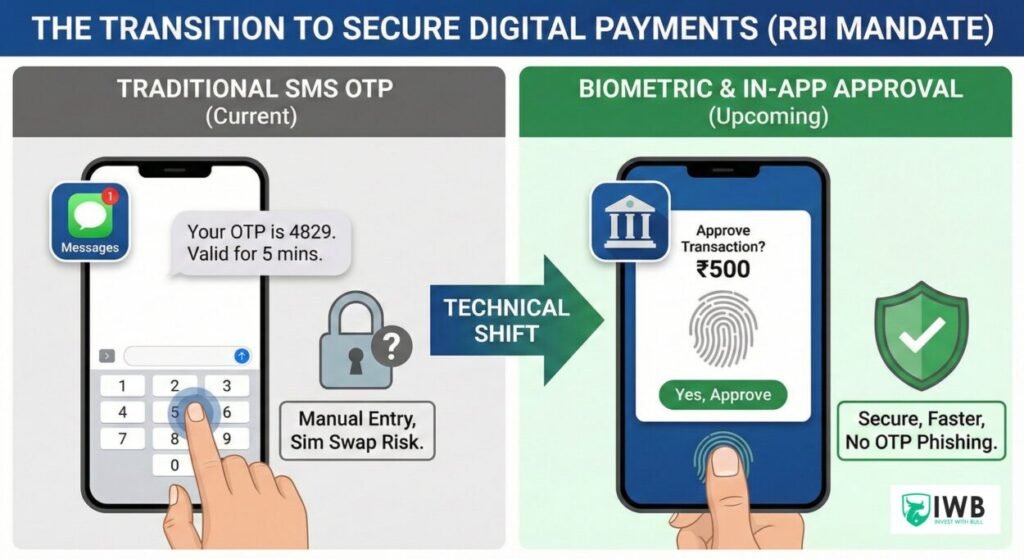

V. Upgraded Security: Tokenization and Dynamic 2FA

Fraud prevention is taking center stage as digital transactions skyrocket.

Dynamic 2FA (Deadline: April 1, 2026)

The RBI’s new Authentication Mechanisms for Digital Payment Transactions Directions recognizes that traditional SMS OTPs are highly vulnerable to SIM swap fraud and phishing. By April 2026, the ecosystem will pivot toward:

- Biometric authentication (fingerprint/FaceID).

- Device-bound approvals.

- Secure, in-app transaction prompts.

Card-on-File (CoF) Tokenization

Merchants (like Amazon, Netflix, or Swiggy) can no longer store your actual 16-digit card number. Instead, your card is converted into a secure, encrypted “token.” Even if a merchant’s database is breached, your real financial data remains completely hidden, making online shopping and auto-debits significantly safer.

VI. Conclusion: Power Shifts Back to the Consumer

The 2026 regulations mark the end of lazy credit practices that primarily benefited card issuers. With faster credit reporting, robust digital security, and transparent billing, the system is designed to reward financial discipline.

Action Steps for You Today:

- Update your banking apps to ensure compatibility with upcoming biometric 2FA features.

- Review your latest credit card statement to confirm no capitalized interest is being applied to late fees.

- Keep your credit utilization below 30% to take full advantage of the upcoming weekly CIBIL reporting.

Frequently Asked Questions (FAQs)

Will SMS OTPs stop working completely in 2026?

Not immediately, but their use will be heavily minimized. The RBI is mandating a shift toward dynamic 2FA, meaning banks will prioritize more secure methods like in-app biometric approvals and device-bound tokens over traditional SMS passwords.

Does weekly credit reporting mean my score will drop faster if I miss a payment?

Yes. Just as positive behaviors (like clearing debt) will boost your score in a matter of days, missed EMIs or late credit card payments will be reported to bureaus like CIBIL much faster, causing a swifter drop in your score.

How does the new minimum amount due rule protect me?

The new RBI rule ensures that your minimum payment covers 100% of the interest generated that month, plus a portion of your principal balance. This stops “negative amortization,” ensuring your total debt actually shrinks when you pay the minimum, rather than growing uncontrollably.

As the Lead Analyst at Invest With Bull, Amit Sharma bridges the gap between complex banking regulations and your wallet. With a core focus on Credit Card Arbitrage and BDA Real Estate, Amit provides the data-backed analysis that salaried professionals need to maximize returns and minimize interest. He is dedicated to building financial literacy through unbiased, actionable research.

RELATED POSTS

View all