Introduction: What No One Tells You About Loans in India

If you’re planning to take a personal loan in India, be it from a bank or an app, this one’s for you.

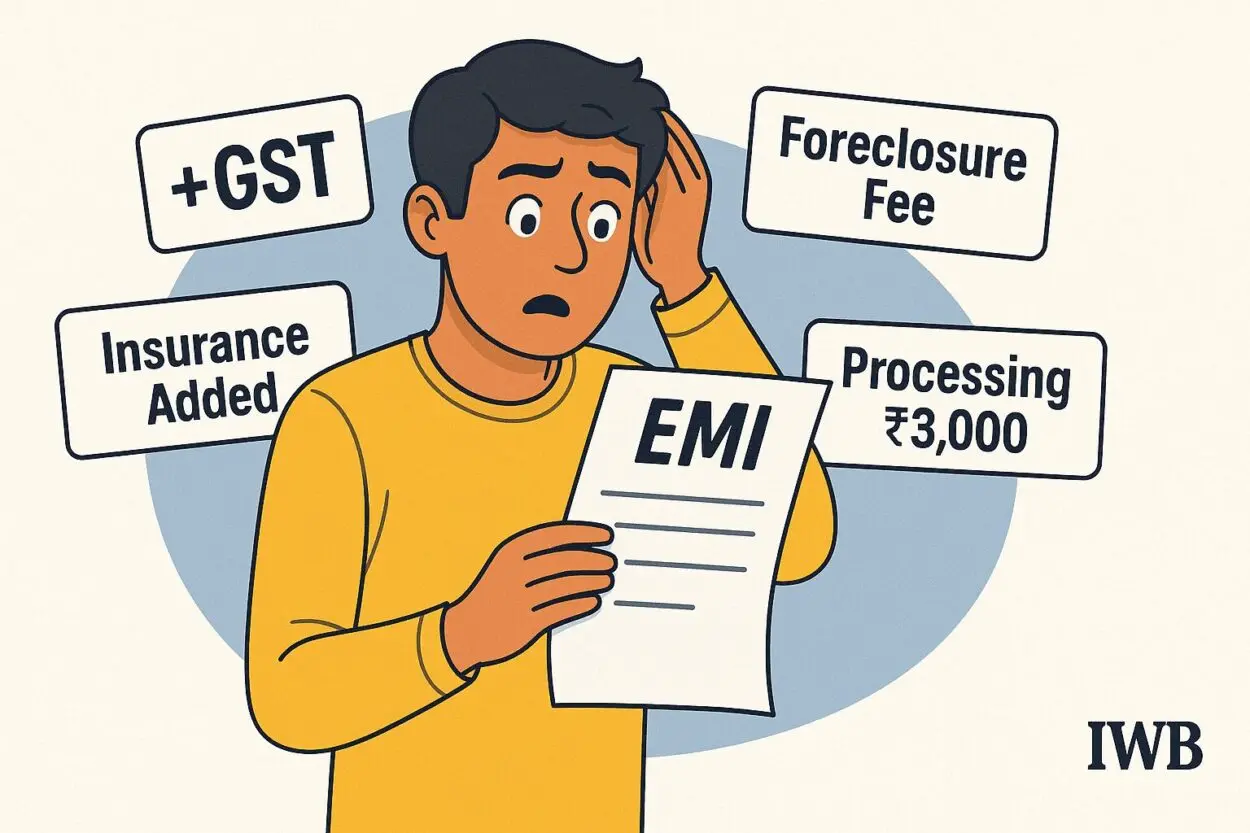

Every month, thousands of borrowers fall into loan traps—sneaky charges, forced insurance policies, hidden fees, and prepayment penalties that were never clearly explained. And once you’ve signed, there’s no going back.

In this guide, we’ll decode the top loan traps to avoid in India, especially if you’re a first-time borrower or don’t fully understand the fine print.

Let’s break it down with real-life scenarios, simplified language, and practical action steps.

1. Personal Loan Hidden Charges in India

Ever taken a ₹1,00,000 loan and received only ₹94,000 in your account? That’s because lenders deduct processing fees upfront, often 2–4% + GST — and you still repay the full ₹1 lakh + interest.

👉 Reality check: You’re paying interest on money you didn’t even receive.

✅ What you should do:

- Always ask for the net disbursal amount

- Compare offers based on total repayment, not just interest rate

2. Is Insurance Mandatory with Personal Loans?

No, it’s not — but many lenders forcefully bundle insurance with your loan, adding ₹5,000–₹15,000 to your cost. You’ll hear, “Sir, it’s for your safety” — but in most cases, it’s unwanted and non-refundable.

What you should do:

- Refuse insurance if you don’t want it

- Ask for a breakdown of insurance premium — in writing

- Choose lenders who let you opt out

3. What is Foreclosure Penalty in Loans?

Let’s say you planned to close your loan early to save interest. Good move? Yes. But some lenders charge 2–5% foreclosure penalty.

So if you repay ₹1 lakh early, you could still lose ₹3,000–₹5,000 in charges.What you should do:

- Ask before signing: “Is there any charge for early repayment?”

- Prefer banks/NBFCs that offer no foreclosure penalty on personal loans

4. Flat Interest Rate vs Reducing Balance – Know the Trick

Some lenders use flat interest rates, which look cheaper but are actually more expensive than reducing balance rates.

Example: 10% flat = ~17–18% effective interest!What you should do:

- Ask for the Effective Annual Rate (EAR)

- Use an online loan interest comparison calculator

5. Shady Loan Apps with Fake Promises

Apps on Play Store promising “Instant Loan in 5 Minutes” often:

- Charge 30–60% annualized interest

- Access your photos & contacts

- Harass you during recovery

What you should do:

- Borrow only from RBI-registered NBFCs or banks

- Check app reviews & privacy policy

- Avoid giving contact/photo access

Real Story: Amit Sharma’s Expensive Lesson

“I took a ₹3 lakh personal loan in 2021. When I tried to close it early, the NBFC charged ₹8,000 for foreclosure + ₹3,000 for ‘admin’ and insurance. That’s ₹11,000 down the drain — for doing the right thing!”

💡 Lesson learned: Always ask every charge in writing before signing.

Loan Safety Checklist for First-Time Borrowers in India

Check This Why It Matters Ask about all charges in advance Avoid surprises post-disbursal Get a breakdown of EMI vs Insurance Remove hidden policies Check early repayment rules Save interest smartly Confirm RBI registration Avoid scam apps Use tools like loan calculators Compare offers wisely

📌 Final Words: Don’t Let Fine Print Fool You

Loan traps don’t look like traps at first. They’re hidden under “terms & conditions”, verbal assurances, and complex paperwork.

But if you ask the right questions, compare total cost (not just interest), and stay alert — you’ll borrow smart and repay smarter.

The most common loan traps in India include:

Always compare total loan cost and read all terms before signing.

No, it is not legally mandatory. Many lenders push insurance to earn commission. You can opt out unless you’re taking a secured loan like a home or car loan that requires protection.

Ask for:

A foreclosure penalty is a charge you pay if you close your loan early before the tenure ends. Some lenders charge 2–5% of the remaining balance. Always check the foreclosure policy before taking the loan.

Only use RBI-registered apps or NBFCs. Many apps charge high interest, access your contacts/photos, and use aggressive recovery tactics. Verify the lender on the RBI website.

Always choose reducing balance interest for lower EMI burden.

Yes — some lenders offer zero foreclosure charges, especially on personal or short-term loans. But many still impose a fee. Confirm this upfront before signing any agreement.

You can verify if a lender is RBI-approved by checking this official page:

👉 RBI NBFC List

Saving money in India isn’t hard — it’s harder when your salary is limited and… Read More

Being a stay-at-home mom doesn’t limit your earning potential. Today, moms across India (and around… Read More

The Indian mutual fund industry just got its biggest shake-up in years. Jio Financial Services… Read More

Introduction Growing your savings in 2025 doesn't have to be complicated or risky. With the… Read More

Want to invest in mutual funds without studying the market? Here are 7 lazy but… Read More

Dreaming of ₹1 crore in 10 years? Here’s a brutally honest, step-by-step plan for regular… Read More