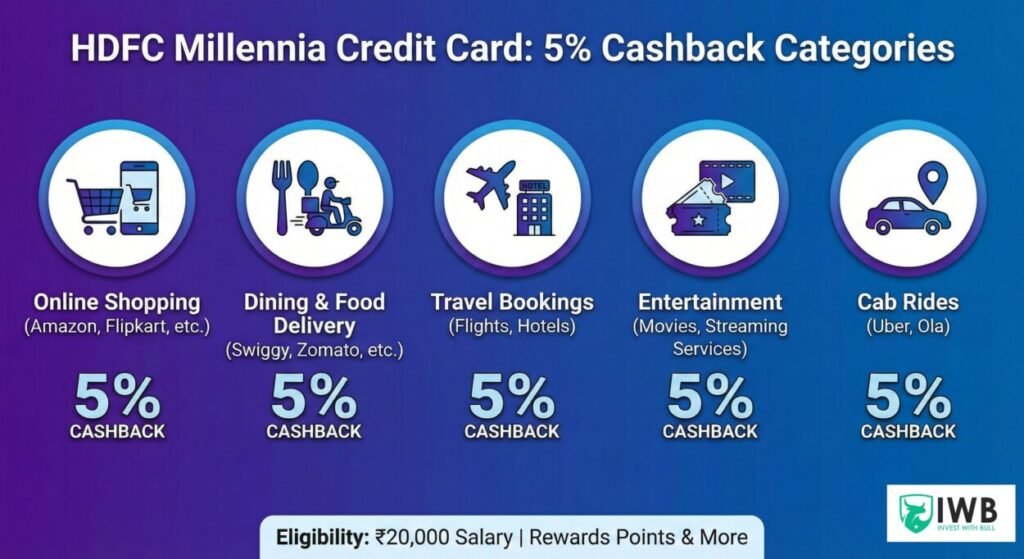

HDFC Millennia Credit Card Eligibility 20000 Salary: 4 Secret Hacks!

Last Updated: 30/01/2026 | by Amit Sharma

Can you achieve HDFC Millennia Credit Card Eligibility with a 20000 salary? While the official bank website states a minimum income of ₹35,000, thousands of salaried employees in India are getting approved with just ₹20,000. In this Invest with Bull exclusive, we reveal the exact “backdoor” strategies to get this premium cashback card even if your salary slip is below the official limit.

🌟 Why is HDFC Millennia the #1 Choice in 2026?

Before we dive into the hacks, it is important to understand why HDFC Millennia Credit Card Eligibility with a 20000 salary is the most searched query for beginners.

- 5% Cashback: Unlimited rewards on Amazon, Flipkart, Swiggy, and Zomato.

- Lounge Access: 8 Domestic airport lounge visits per year.

- Direct Value: 1 CashPoint equals ₹1, making it the most transparent reward system in India.

How to Meet HDFC Millennia Credit Card Eligibility with a 20000 Salary

1. The “Upgrade Ladder” Strategy

If you apply directly, the AI-based approval system might reject you. Instead, apply for the HDFC MoneyBack+ card, which only requires a ₹20k income. Use it for 6 months, and you will see a pre-approved upgrade to Millennia in your HDFC MyCards app.

2. The Salary Account Advantage

Having your salary credited to HDFC is a massive trust signal. If you maintain a consistent balance for 3-4 months, the bank often overlooks the ₹35k rule and offers the card as a Lifetime Free (LTF) reward to loyal customers.

3. Card-on-Card (C4C) Application

Do you have an SBI or ICICI card with a ₹1 Lakh limit? You can bypass income documents entirely! Visit an HDFC branch and apply via the Card-on-Card route using your existing card’s statement as proof of creditworthiness.

4. The FD-Backed Route (The Guaranteed Method)

If you have zero credit history, open a Fixed Deposit of ₹1.5 Lakh. This guarantees HDFC Millennia Credit Card Eligibility with a 20000 salary because the card is “secured” against your savings.

Quick Comparison: Which level are you on?

| Feature | MoneyBack+ (Level 1) | Millennia (Level 5) |

| Salary Needed | ₹15k – ₹20k | ₹35k (Official) / ₹20k (Hack) |

| Online Cashback | 10X Points (~2.5%) | 5% Flat Cashback |

| Lounge Access | No | Yes (1 per quarter) |

| Annual Fee | ₹500 | ₹1,000 |

Frequently Asked Questions

What is the real HDFC Millennia Credit Card Eligibility for a 20000 salary?

Officially, it is ₹35k. However, through the HDFC Salary Account relationship or the MoneyBack+ upgrade path, you can easily get it with ₹20,000 per month.

Can I get HDFC Millennia if my salary is 20k?

Yes. While a direct application might be rejected, you can get it by upgrading from a MoneyBack+ card or applying against a Fixed Deposit (FD) of at least ₹1 Lakh.

Is HDFC Millennia better than SBI Cashback card?

The HDFC Millennia is better for users who want airport lounge access and milestone vouchers. The SBI Cashback card is better for 5% cashback on any online site without merchant restrictions.

What CIBIL score is needed for HDFC Millennia?

A CIBIL score of 750+ is highly recommended. If your score is lower, the bank may reject your application even if you meet the income criteria.

How to Improve Credit Score

What is the real HDFC Millennia Credit Card Eligibility for a 20000 salary?

Officially, it is ₹35k. However, through the HDFC Salary Account relationship or the MoneyBack+ upgrade path, you can easily get it with ₹20,000 per month.

Does HDFC Millennia require a high CIBIL score?

Yes, a CIBIL score of 750+ is generally required. If your score is high, the bank is more likely to relax the income requirements.

Which credit card is best for a ₹35,000 salary?

For a salary of ₹35,000 per month, you qualify for several “value-for-money” cards that offer great rewards. The SBI Cashback Card (5% online cashback) and the HDFC Millennia are top-tier choices for this income bracket.

What is the minimum salary required for an SBI credit card?

For popular entry-level cards like the SBI SimplyCLICK, the minimum salary is generally ₹18,000 to ₹20,000 per month. For premium variants, the requirement can exceed ₹60,000 per month.

Can I apply for a credit card with a low salary?

Yes. If your salary is low (below ₹15,000), consider these options:

Secured Credit Cards: Cards like the IDFC FIRST Wow or Kotak 811 #DreamDifferent require no income proof and are issued against an FD.

Add-on Cards: You can get an add-on card linked to a family member’s primary credit card account.

Quick Eligibility Table: Top Indian Banks (2026)

| Bank | Min. Monthly Salary (Entry-Level) | Popular Card |

| SBI Card | ₹18,000 – ₹20,000 | SimplyCLICK |

| HDFC Bank | ₹12,000 – ₹25,000 | HDFC MoneyBack+ |

| Axis Bank | ₹15,000 – ₹25,000 | Axis ACE |

| ICICI Bank | ₹15,000 – ₹20,000 | Amazon Pay ICICI |

| Amex | ₹37,500 (Annual ₹4.5L) | Amex SmartEarn |

The video below provides a modern expert’s perspective on the best credit card stacks for 2026, including beginner-friendly options that align with different salary levels.

Top Card Picks for 2026: Expert Aly Hajiani highlights the HDFC BizBlack [41:40] as a top choice for business owners/freelancers and the Axis Magnus Burgundy [42:46] for high-end rewards.

The “35 Points” Hack: The video explains how the Axis Magnus Burgundy triples your points (from 12 to 35 points per ₹200) once you spend over ₹1.5 lakh in a month [43:16].

Credit Card “Excursion” Strategy: A great tip for your travel-focused readers i

s the “stopover” trick, where you can visit an extra country (like Singapore or Qatar) on the same ticket for zero extra points [32:13].

Gold Purchase Hack: There is a detailed breakdown on buying Tanishq or Kalyan gold coins on Myntra using credit card vouchers to get up to 18% back in value [54:35].

Best Entry-Level Tips: For those with a lower salary (around ₹20k-₹25k), the video recommends the SBI SimplyClick or Scapia for travelers starting out [19:05].

As the Lead Analyst at Invest With Bull, Amit Sharma bridges the gap between complex banking regulations and your wallet. With a core focus on Credit Card Arbitrage and BDA Real Estate, Amit provides the data-backed analysis that salaried professionals need to maximize returns and minimize interest. He is dedicated to building financial literacy through unbiased, actionable research.

RELATED POSTS

View all