Elixir Card Review 2026: Is This the Best “Health” Card in India?

Published: 20/02/2026 | by Amit Sharma

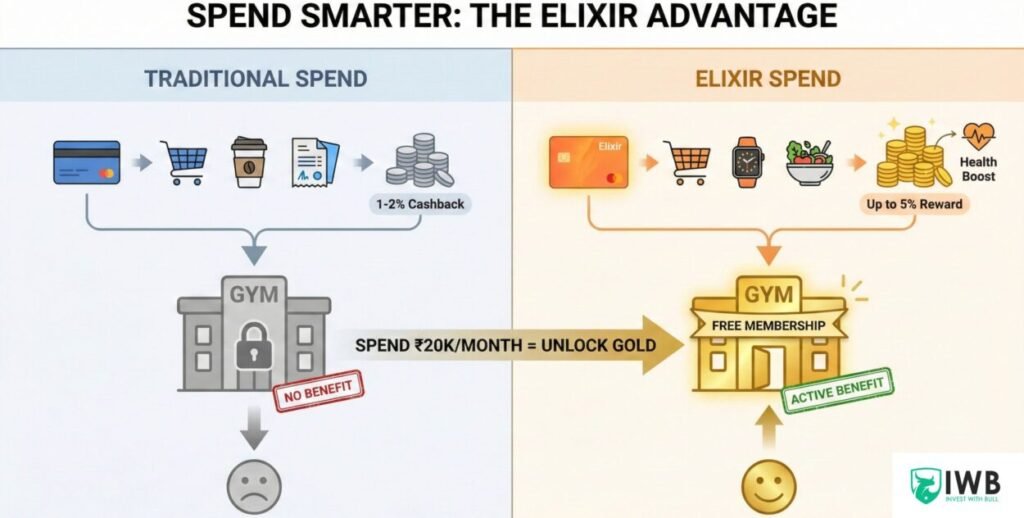

Getting fit in 2026 is no longer just about the sweat—it’s about the “smart” spend. If you’ve been scrolling through Instagram and seeing the Elixir Card promising a free gym membership, you’re likely wondering if it’s a fintech miracle or just clever marketing.

With gym memberships in cities like Bangalore, Delhi, and Mumbai costing anywhere between ₹12,000 to ₹18,000 annually, the idea of getting that money back simply by buying groceries and paying utility bills is enticing.

This comprehensive guide dives into the Elixir Card review, the math behind the rewards, and how you can maximize your “Elixir Coins” to fund your fitness journey.

The Elixir Card, launched by Paperstack Technologies, is a Visa Platinum Prepaid Card (issued in partnership with LivQuik). Unlike traditional cashback cards that offer generic rewards on travel or dining, Elixir is laser-focused on one niche: Wellness.

How the Elixir Card Works: A Quick Snapshot

- Card Type: Visa Prepaid (Load-and-Spend).

- Reward Currency: Elixir Coins (1 Coin = ₹1).

- Base Reward Rate: 3% on almost all spends.

- Boosted Reward Rate: Up to 5% by syncing fitness wearables.

- Health Brand Rate: 10% (2X rewards) on nutrition, athleisure, and skincare.

- Annual Fee: ₹0 (Lifetime Free).

The “Free Gym” Math: Does it Add Up?

The core promise of the Elixir Card is: Spend ₹20,000 monthly = Get a FREE Gym Membership. Let’s break down the 2026 numbers for a cultpass ELITE membership, which is the primary partner for this offer.

1. The Cost of Fitness

As of early 2026, a 12-month cultpass ELITE membership typically retails around ₹15,950 (roughly ₹1,330 per month). To get this for “free,” you need to earn an equivalent amount in Elixir Coins.

2. The Spending Calculation

If you use the Elixir card for your monthly expenses (rent via UPI, groceries, fuel, and Amazon shopping):

- Monthly Spend: ₹20,000

- Reward Rate (Active): 5% (assuming you hit your daily step and sleep goals).

- Monthly Earnings: ₹1,000 (20,000 * 5%).

- The Result: While ₹1,000 covers a large chunk of a monthly gym installment, hitting ₹26,000 to ₹30,000 in monthly spend (or shopping at 10% 2X partner brands) would fully subsidize a premium ELITE membership.

Moving Beyond 3%: How to Unlock the 5% “Active” Boost

One of the most innovative (and slightly controversial) features of the Elixir Card is its integration with your health data. To jump from the base 3% to 5% rewards, you must:

- Sync your Wearable: Connect an Apple Watch, Garmin, or Fitbit via the Elixir app.

- Hit Your Targets: The app sets movement (calories burned) and recovery (sleep duration) goals.

- Consistency: Staying “active” in the app’s eyes unlocks the higher tier for the next 24-48 hours of spending.

Privacy Note: Elixir is compliant with India’s Digital Personal Data Protection (DPDP) Act. They claim to use health data only for reward calculations and do not share medical records with third parties.

Elixir Card vs. The Competition (2026)

How does this prepaid card stack up against established “Wellness” credit cards in India?

| Feature | Elixir Card (Prepaid) | SBI Card PULSE | Apollo SBI Card |

| Joining/Annual Fee | ₹0 | ₹1,499 | ₹1,499 |

| Gym Benefit | 100% Cashback (via spend) | FITPASS PRO (12 sessions/mo) | FITPASS PRO (1 year) |

| Rewards | 3% – 10% | 10 Points/₹100 (Pharmacy) | 10 Points/₹100 (Apollo) |

| Approval Ease | High (Instant KYC) | Moderate (CIBIL based) | Moderate (CIBIL based) |

Getting fit in 2026 is no longer just about the sweat—it’s about the “smart” spend. If you’ve been scrolling through Instagram and seeing the Elixir Card promising a free gym membership, you’re likely wondering if it’s a fintech miracle or just clever marketing.

With gym memberships in cities like Bangalore, Delhi, and Mumbai costing anywhere between ₹12,000 to ₹18,000 annually, the idea of getting that money back simply by buying groceries and paying utility bills is enticing.

This comprehensive guide dives into the Elixir Card review, the math behind the rewards, and how you can maximize your “Elixir Coins” to fund your fitness journey.

Elixir Card Review 2026: Is This the Best “Health” Card in India?

The Elixir Card, launched by Paperstack Technologies, is a Visa Platinum Prepaid Card (issued in partnership with LivQuik). Unlike traditional cashback cards that offer generic rewards on travel or dining, Elixir is laser-focused on one niche: Wellness.

How the Elixir Card Works: A Quick Snapshot

- Card Type: Visa Prepaid (Load-and-Spend).

- Reward Currency: Elixir Coins (1 Coin = ₹1).

- Base Reward Rate: 3% on almost all spends.

- Boosted Reward Rate: Up to 5% by syncing fitness wearables.

- Health Brand Rate: 10% (2X rewards) on nutrition, athleisure, and skincare.

- Annual Fee: ₹0 (Lifetime Free).

The “Free Gym” Math: Does it Add Up?

The core promise of the Elixir Card is: Spend ₹20,000 monthly = Get a FREE Gym Membership. Let’s break down the 2026 numbers for a cultpass ELITE membership, which is the primary partner for this offer.

1. The Cost of Fitness

As of early 2026, a 12-month cultpass ELITE membership typically retails around ₹15,950 (roughly ₹1,330 per month). To get this for “free,” you need to earn an equivalent amount in Elixir Coins.

2. The Spending Calculation

If you use the Elixir card for your monthly expenses (rent via UPI, groceries, fuel, and Amazon shopping):

- Monthly Spend: ₹20,000

- Reward Rate (Active): 5% (assuming you hit your daily step and sleep goals).

- Monthly Earnings: ₹1,000 (20,000 * 5%).

- The Result: While ₹1,000 covers a large chunk of a monthly gym installment, hitting ₹26,000 to ₹30,000 in monthly spend (or shopping at 10% 2X partner brands) would fully subsidize a premium ELITE membership.

Moving Beyond 3%: How to Unlock the 5% “Active” Boost

One of the most innovative (and slightly controversial) features of the Elixir Card is its integration with your health data. To jump from the base 3% to 5% rewards, you must:

- Sync your Wearable: Connect an Apple Watch, Garmin, or Fitbit via the Elixir app.

- Hit Your Targets: The app sets movement (calories burned) and recovery (sleep duration) goals.

- Consistency: Staying “active” in the app’s eyes unlocks the higher tier for the next 24-48 hours of spending.

Privacy Note: Elixir is compliant with India’s Digital Personal Data Protection (DPDP) Act. They claim to use health data only for reward calculations and do not share medical records with third parties.

Elixir Card vs. The Competition (2026)

How does this prepaid card stack up against established “Wellness” credit cards in India?

| Feature | Elixir Card (Prepaid) | SBI Card PULSE | Apollo SBI Card |

| Joining/Annual Fee | ₹0 | ₹1,499 | ₹1,499 |

| Gym Benefit | 100% Cashback (via spend) | FITPASS PRO (12 sessions/mo) | FITPASS PRO (1 year) |

| Rewards | 3% – 10% | 10 Points/₹100 (Pharmacy) | 10 Points/₹100 (Apollo) |

| Approval Ease | High (Instant KYC) | Moderate (CIBIL based) | Moderate (CIBIL based) |

Key Takeaway: If you want a lifetime free card without the hassle of a credit score check, Elixir is the winner. If you want complimentary health checkups and insurance, the SBI Pulse might be better.

Pros and Cons of the Elixir Card

The Pros

- High Reward Floor: Even the 3% base reward is higher than many entry-level credit cards.

- Zero Debt Risk: Being a prepaid card, you can’t overspend or fall into an interest trap.

- 2X on Health Brands: Perfect if you already buy supplements from MuscleBlaze or apparel from HRX.

- Smooth UI: The app is designed for Gen-Z and Millennials, with instant reward credit (usually within 24 hours).

The Cons

- Load-and-Spend: You have to remember to load money into the card, which can be a hurdle for some.

- Reward “Coins”: Unlike direct cashback to your bank, you earn Elixir Coins which are best spent within their ecosystem or on vouchers.

- Privacy Trade-off: You are essentially trading your sleep and movement data for an extra 2% cashback.

Frequently Asked Questions (FAQ)

Is the Elixir Card safe to use?

Yes. The card is a Visa Platinum card issued by LivQuik, an RBI-authorized Prepaid Payment Instrument (PPI) issuer. Your funds are held in an escrow account as per RBI mandates.

Can I use Elixir Coins for anything other than a gym?

Yes. Elixir Coins (1 Coin = ₹1) can be redeemed for various health-related vouchers, nutrition products, or at partner brands like Cult.fit, HealthKart, and various athleisure stores.

Do I get rewards on rent and fuel?

Most credit cards are cutting rewards on “excluded categories” like rent, fuel, and utilities. As of 2026, the Elixir Card still offers rewards on these categories, making it a “catch-all” card for monthly bills.

What is the maximum reward I can earn?

There is currently no hard cap on the 3% – 5% rewards, which makes it highly lucrative for high-spenders.

Final Verdict: Is it Worth It?

The Elixir Card is a game-changer for someone who is already spending ₹20k–₹30k a month and wants to “gamify” their fitness. It effectively turns your mandatory monthly bills into a subsidized gym membership. However, if you are uncomfortable sharing your fitness data with a fintech app, you might prefer a traditional credit card like the SBI Pulse.

The Elixir Card really shines for those looking to keep their finances in check while staying fit. It’s perfect for fitness enthusiasts who love the idea of earning rewards just for working out. But if you’re not cool with sharing your fitness info, you might want to stick to something more traditional like the SBI Pulse. Overall, it’s a solid choice if you’re ready to turn those monthly expenses into health perks!

As the Lead Analyst at Invest With Bull, Amit Sharma bridges the gap between complex banking regulations and your wallet. With a core focus on Credit Card Arbitrage and BDA Real Estate, Amit provides the data-backed analysis that salaried professionals need to maximize returns and minimize interest. He is dedicated to building financial literacy through unbiased, actionable research.

RELATED POSTS

View all