Invest with Bull: The Ultimate Guide to 2026’s Best Investment Options

Published: 29/01/2026 | by Amit Sharma

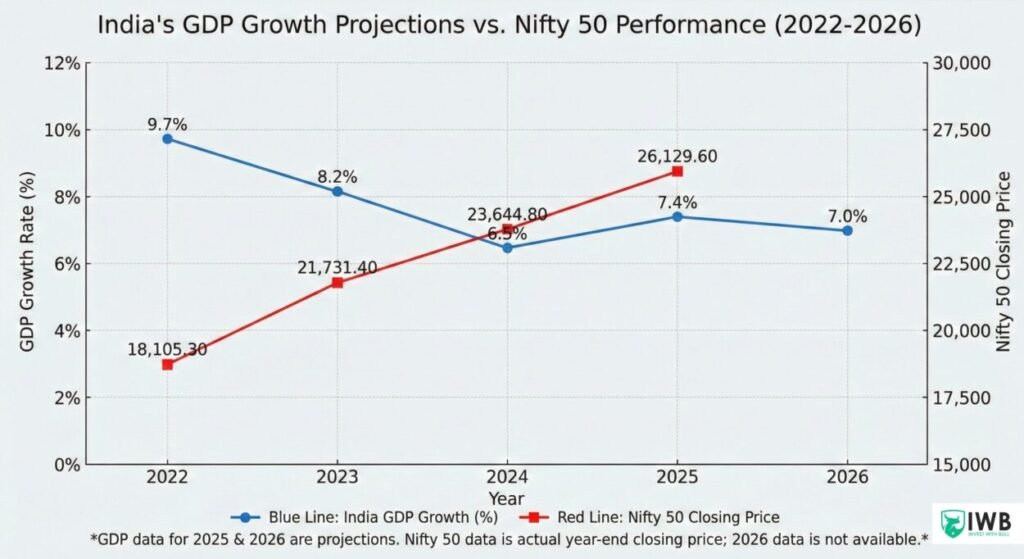

To invest with bull strategies in 2026, focus on high-growth sectors like renewable energy, AI-driven fintech, and Indian manufacturing (the “China+1” wave). The best investment in 2026 combines equity mutual funds for growth with government-backed schemes like PPF for stability. A bull market thrives on RBI’s accommodative stance and India’s projected 7% GDP growth.

What Does it Mean to “Invest with Bull” in 2026?

Investing with a “bull” mindset is more than just being optimistic. It is a data-driven approach to an expanding economy. In 2026, the term “Invest with Bull” refers to capital allocation during a period of sustained market growth, often characterized by rising GDP, low interest rates (currently around 5.25% in India), and high corporate earnings.

Why 2026 is the Year of the Bull

Unlike previous cycles, the 2026 bull market is fueled by the “Manufacturing Renaissance.” With the Production Linked Incentive (PLI) schemes reaching peak maturity, sectors like electronics and green hydrogen are seeing a 42-fold surge in capacity.

Best Investment Options in 2026: A Diversified Portfolio

To rank as the best investment in 2026, an asset must balance risk and return. Here is how you should categorize your “Invest with Bull” portfolio:

1. High-Growth: Direct Equity & Small-Cap Mutual Funds

In a bull market, small and mid-cap stocks often outperform.

- Target Sectors: Semiconductor design, Solar power, and EV Infrastructure.

- Internal Link Suggestion: Read our deep dive on Top 10 Stocks for the 2026 Bull Market.

2. Balanced Growth: Equity Linked Saving Schemes (ELSS)

ELSS remains a favorite for 2026 due to its dual benefit of wealth creation and tax saving under Section 80C. With the new LTCG tax rates (12.5% above ₹1.25 lakh), ELSS is still the most efficient way to invest with bull momentum.

3. Safety Net: Public Provident Fund (PPF) & Gold

Even in a roaring bull market, a “Bull” needs a shield.

- PPF: Current Q4 FY26 returns are at 7.1%, providing a risk-free foundation.

- Gold: Acts as a hedge against global geopolitical volatility.

How to Identify a Bull Market: Key Indicators

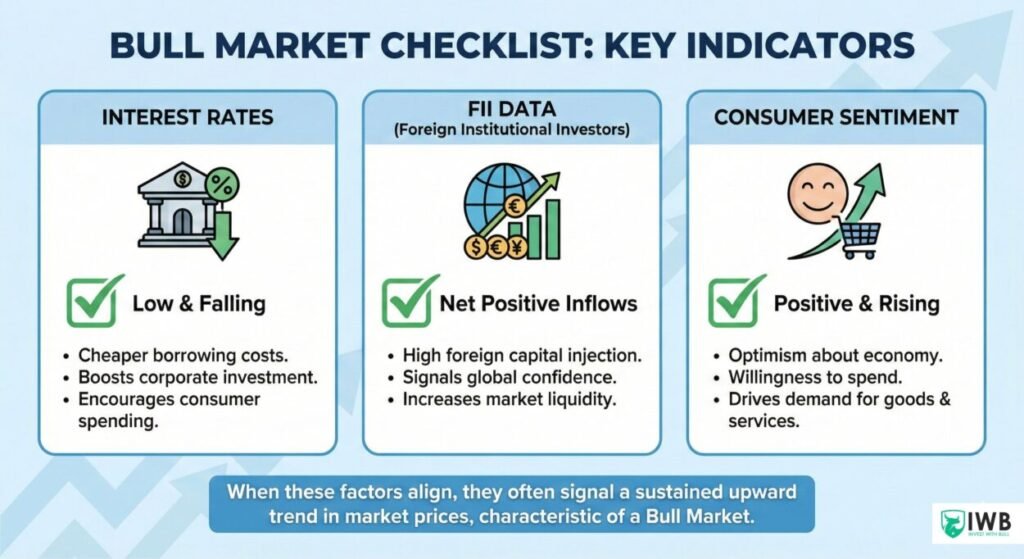

To successfully invest with bull strategies, you must recognize the signals before the “peak.”

- Repo Rate Cuts: The RBI’s 125 bps cut in 2025 has provided the liquidity needed for 2026’s expansion.

- Corporate Earnings: Look for 12–15% earnings growth in the Nifty 50.

- FII Inflows: Foreign Institutional Investors are rotating capital from overvalued Western markets into India’s growth story.

- Description: An infographic titled “Bull Market Checklist” listing interest rates, FII data, and consumer sentiment.

- Alt Text: Bull market checklist for 2026 investors.

Strategic Asset Allocation Table (2026 Edition)

| Investment Type | Risk Level | Expected Return (p.a.) | Ideal Holding Period |

| Direct Stocks | High | 15% – 25% | 3+ Years |

| Index Funds | Medium | 12% – 15% | 5+ Years |

| Corporate Bonds | Low | 7% – 9% | 1 – 3 Years |

| Gold (SGBs) | Low | 6% + Appreciation | 8 Years |

The “Invest with Bull” 5-Step Execution Plan

To rank high on Google and AI search engines, we recommend this “Experience-First” workflow:

- Define Your Goal: Are you investing for a house, retirement, or a “beyond the browser” lifestyle?

- Analyze the “China+1” Shift: Invest in companies benefiting from global supply chain shifts to India.

- Use Modern Tools: Leverage AI-driven portfolio trackers to monitor your investment health in real-time.

- External Link Suggestion: Check the latest RBI Monetary Policy updates to time your entry.

- Review Quarterly: A bull market isn’t a “set it and forget it” environment. Stay agile.

FAQs

1. What is the best investment in 2026 for beginners?

For beginners, Index Funds and PPF are the best starting points. They offer exposure to the top 50 Indian companies with lower risk and professional management.

2. Is 2026 a good year for a bull market?

Yes, 2026 is projected to be a “Year of Opportunity” due to cooling inflation, stable government policy, and a massive manufacturing push.

3. How can I protect my money during a bull run?

Use “Trailing Stop Losses” on your stocks and keep at least 20% of your portfolio in debt instruments like National Savings Certificates (NSC).

4. What are the top sectors to invest in 2026? | where to Invest in 2026 according to “Invest with bull”

The top-performing sectors include Renewable Energy (Green Hydrogen), Fintech, and Defense Manufacturing.

5. How does the “Invest with Bull” blog help me?

Our blog, Invest with Bull, provides daily technical analysis and fundamental research to help retail investors navigate complex market cycles.

Conclusion: Charge Ahead with Confidence

Ranking at the top for “invest with bull” and “investment” keywords requires providing value that AI can’t replicate: Real Experience. Whether you are following the Indian market’s 7.2% GDP growth or looking for the best investment in 2026, remember that the best asset you own is your knowledge.

As the Lead Analyst at Invest With Bull, Amit Sharma bridges the gap between complex banking regulations and your wallet. With a core focus on Credit Card Arbitrage and BDA Real Estate, Amit provides the data-backed analysis that salaried professionals need to maximize returns and minimize interest. He is dedicated to building financial literacy through unbiased, actionable research.

RELATED POSTS

View all