Amazing Power of NPS 2026: The Ultimate Guide to Growing ₹10,000 into ₹6.23 Crores

Last Updated: 29/01/2026 | by Amit Sharma

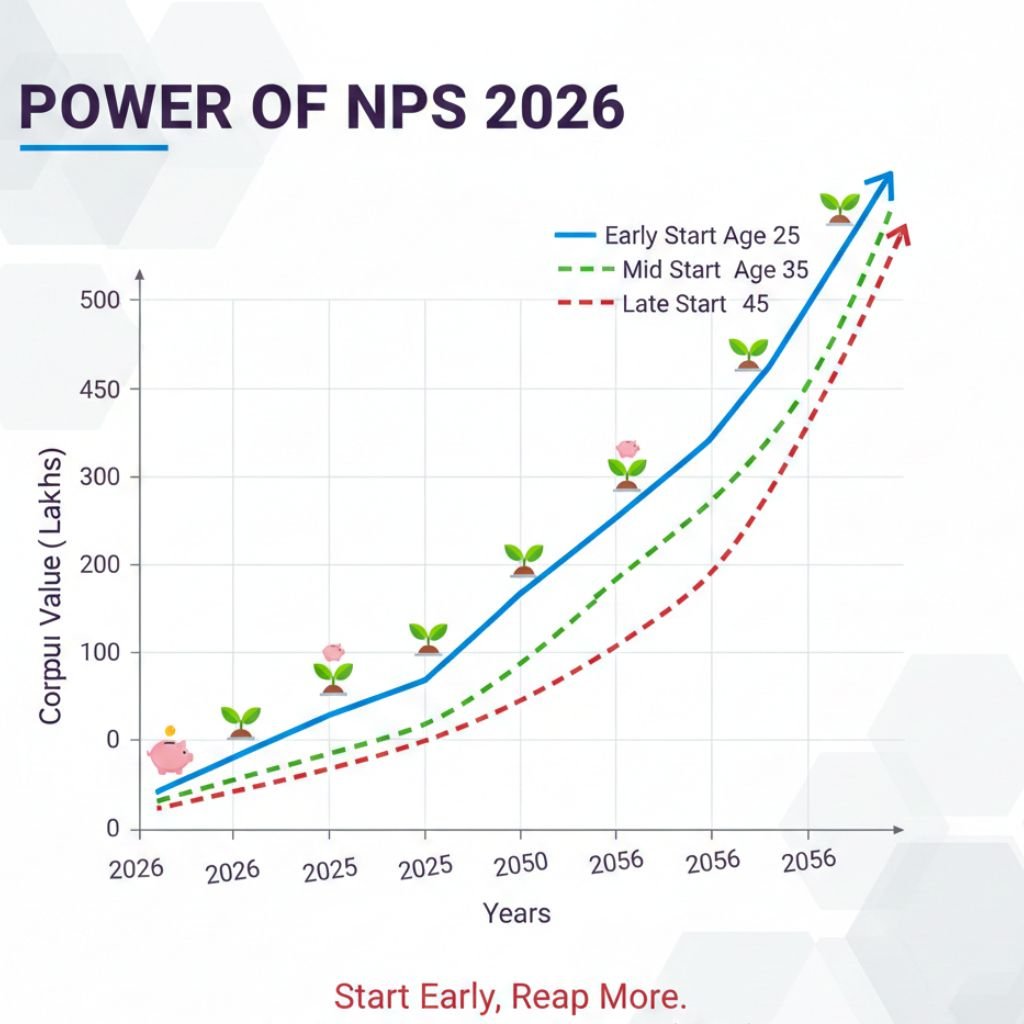

Power of NPS 2026: Is the National Pension System (NPS) still the best retirement tool in 2026? With new 2026 rules allowing 100% lump sum withdrawals for smaller corpuses and increased flexibility in annuity purchases, the “Power of Compounding” in NPS is more accessible than ever.

If you start today with just ₹10,000/month, you aren’t just saving; you are building a ₹6.23 Crore legacy. Here is the data-backed breakdown of how the NPS math works in the current market.

The NPS Compounding Math: ₹10k to ₹6.23 Crore

To understand how a small monthly SIP can lead to massive wealth, we look at a 30-year horizon with a realistic 10% XIRR (Internal Rate of Return).

| Investment Period | Total Principal Invested | Estimated Corpus (10% XIRR) | Wealth Gained (Profit) |

| 10 Years | ₹12,00,000 | ₹20.63 Lakhs | ₹8.63 Lakhs |

| 20 Years | ₹24,00,000 | ₹76.50 Lakhs | ₹52.50 Lakhs |

| 30 Years | ₹36,00,000 | ₹6.23 Crores | ₹5.87 Crores |

Expert Insight: In 2026, NPS fund managers have expanded their reach into IPOs and a broader universe of 200+ stocks, making a 10-12% average return more sustainable for aggressive (Tier-E) portfolios.

How to Build a ₹1 Crore Corpus on a Normal Salary

Why the Power of NPS 2026 is Unbeatable for Retirement

Everyone is talking about NPS this year because the PFRDA (Amendment) Regulations 2025/26 have made the scheme more “investor-friendly” than traditional PFs or FDs.

1. Enhanced Withdrawal Flexibility

- 100% Lump Sum: If your corpus is ₹8 Lakhs or less, you can now withdraw the entire amount tax-free—no mandatory annuity required.

- Reduced Annuity: For corpuses above ₹12 Lakhs, non-government subscribers can now opt to buy an annuity for only 20% of the wealth (previously 40%), keeping 80% as a lump sum.

2. Systematic Unit Redemption (SUR)

Think of this as the “NPS version of an SWP.” You can now systematically redeem your units over time rather than taking one giant lump sum, providing better tax management and market-timing advantages.

3. Triple Tax Advantage (Old vs. New Regime)

- Section 80CCD(1B): Exclusive ₹50,000 deduction (Old Regime) over and above the ₹1.5L 80C limit.

- Section 80CCD(2): Employer contributions up to 14% (for Government) or 10% (Private) of salary are tax-deductible, even in the New Tax Regime.

- EEE Status: Your investment, the growth, and 60% of the withdrawal remain entirely tax-exempt.

How to Start a SIP in Mutual Funds for Lazy People

Real-Life Example: The “Ankit Strategy” in 2026

Ankit, a 30-year-old Senior Manager, starts an NPS Tier-1 account in 2026. He chooses the “Active Choice” with 75% equity allocation.

- Monthly Contribution: ₹10,000

- Age at Exit: 60 Years

- Total Corpus: ₹6.23 Crore

- Lump Sum (80% Option): ₹4.98 Crore (Available under 2026 rules)

- Annuity (20% Option): ₹1.25 Crore

- Estimated Monthly Pension: ~₹65,000+

By leveraging the new 20% annuity rule, Ankit keeps more of his wealth liquid while still securing a comfortable monthly “salary” for life.

How to Open Your NPS Account in 10 Minutes

- Visit a CRA Portal: Use NSDL or Protean eGov.

- Use Your Bank App: Most major banks (SBI, HDFC, ICICI) have an “Invest in NPS” tab.

- Third-Party Apps: Platforms like Zerodha, Groww, or Paytm Money offer paperless onboarding.

- Requirements: You only need your PAN, Aadhaar, and a mobile-linked bank account.

2026 Comparison: NPS vs. EPF vs. PPF

| Feature | National Pension System (NPS) | Employee Provident Fund (EPF) | Public Provident Fund (PPF) |

| Current Return Rate | 9% – 12% (Market-linked) | 8.25% (Fixed for FY 25-26) | 7.1% (Fixed/Quarterly) |

| Risk Profile | Moderate (linked to Equity/Debt) | Low (Government-backed) | Risk-Free (Sovereign Guarantee) |

| Tax Status | EEE (Exempt-Exempt-Exempt) | EEE (up to ₹2.5L/year contribution) | EEE (Exempt-Exempt-Exempt) |

| Additional Tax Benefit | ₹50,000 extra (u/s 80CCD 1B) | None beyond 80C | None beyond 80C |

| Lock-in Period | Until Age 60 | Until Retirement / Job Exit | 15 Years |

| Liquidity | Partial (after 3 years; conditions) | Partial (medical, home, marriage) | Partial (after 5th year) |

| Max Investment | No Upper Limit | No Limit (VPF allowed) | ₹1.5 Lakh per year |

Frequently Asked Questions (2026 Update)

Is NPS better than Mutual Fund SIPs?

NPS provides a unique tax benefit (₹50k extra) that Mutual Funds don’t. However, Mutual Funds offer 100% liquidity. For retirement, many experts recommend a “Core and Satellite” approach: NPS as the core (tax-saving) and Mutual Funds for liquidity.

What is the lock-in period now?

While NPS is geared for age 60, you can now make up to 4 partial withdrawals (up to 25% of your contribution) for specific needs like education, medical emergencies, or home buying, provided there is a 4-year gap between withdrawals.

Can I stay in NPS after 60?

Yes! The 2026 guidelines allow you to remain invested until age 85, allowing your money to keep compounding even after you stop working.

What is the average return on NPS?

NPS (National Pension System) returns aren’t fixed but typically range from 9% to 12% annually, varying with market conditions and your investment mix (equities, corporate bonds, government securities). Returns are market-linked, offering potential growth but with moderate risk, often outperforming traditional fixed deposits but requiring a long-term commitment for best results.

Which is better, LIC or NPS?

NPS is generally superior for wealth creation because it offers historically higher market-linked returns (9%–12%) and an additional ₹50,000 tax deduction (Section 80CCD), whereas LIC traditional plans typically yield lower guaranteed returns (5%–6%).

Final Thought: The best time to start was yesterday; the second-best time is today. With ₹10,000 a month, you aren’t just saving for the future—you’re ensuring your 60-year-old self is a multi-crorepati.

As the Lead Analyst at Invest With Bull, Amit Sharma bridges the gap between complex banking regulations and your wallet. With a core focus on Credit Card Arbitrage and BDA Real Estate, Amit provides the data-backed analysis that salaried professionals need to maximize returns and minimize interest. He is dedicated to building financial literacy through unbiased, actionable research.

RELATED POSTS

View all