Why I Told My Brother to Stop Investing and Start an “Emergency Fund” (The 2026 Blueprint)

Published: 26/01/2026 | by Amit Sharma

The brutal truth of 2026: Most of us are one medical bill or one “AI restructuring” away from total financial collapse.

You see it on social media—people bragging about their 15% stock gains or crypto “mooning.” But ask them what happens if their laptop breaks or their company downsizes tomorrow? Total silence. If you’re living paycheck to paycheck, you don’t have an investment problem. You have a stability problem. My brother Amit and I realized this the hard way. Here is the exact plan we used to build a safety net when it felt like we had no money left.

🛑 The “Instant Debt” Trap

In 2026, “Buy Now, Pay Later” (BNPL) and 10-minute personal loans are everywhere. They feel like a lifesaver, but they are actually financial quicksand. Medical inflation in India is currently hitting 14% annually—the highest in Asia. A routine hospital stay that cost ₹50,000 a few years ago now easily crosses ₹1.2 Lakh. An emergency fund isn’t just “savings”; it’s your Exit Interview from Debt.

[Place Image 1: A “Financial Safety Net” vs “Debt Trap” infographic showing a person falling into a net vs a dark hole of loans.]

🛠 The 2026 “Survival Number” (Salary: ₹30,000)

If you earn ₹30,000 in a city like Delhi or Bangalore, saving feels impossible. But it’s about intent, not the amount.

A Realistic Monthly Budget for ₹30k Income:

| Category | Amount (₹) | Action |

| Rent & Utilities | ₹12,000 | Fixed |

| Groceries & Food | ₹6,000 | The “Anti-Zomato” Zone |

| Transport | ₹2,000 | Fixed |

| Emergency Fund (Savings) | ₹3,000 | Automated (1st of Month) |

| Investments (SIP/PPF) | ₹2,000 | Future Wealth |

| Wants/Lifestyle | ₹5,000 | Variable |

The Goal: Your target fund should be 6 months of expenses. At ₹25,000/month of essentials, that’s ₹1.5 Lakh.

📈 Real Talk: How Amit Sharma Went from ₹0 to ₹1 Lakh

Amit (my brother and co-writer) was the king of “zero balance” by the 25th of every month. He changed everything with one simple rule: The 10% Pay-Yourself-First Rule.

- Automation: He didn’t wait to see what was left. He set a recurring transfer for the 1st of the month.

- The “Substitute” Strategy: Instead of skipping hangouts, he’d go out but skip the expensive meal. That ₹500 saved went instantly into his fund via UPI.

- The Payoff: When the 2025 tech shifts happened, Amit was laid off. While his peers took 36% interest credit card loans, Amit sat back and spent 3 months upskilling. That fund bought him a better career.

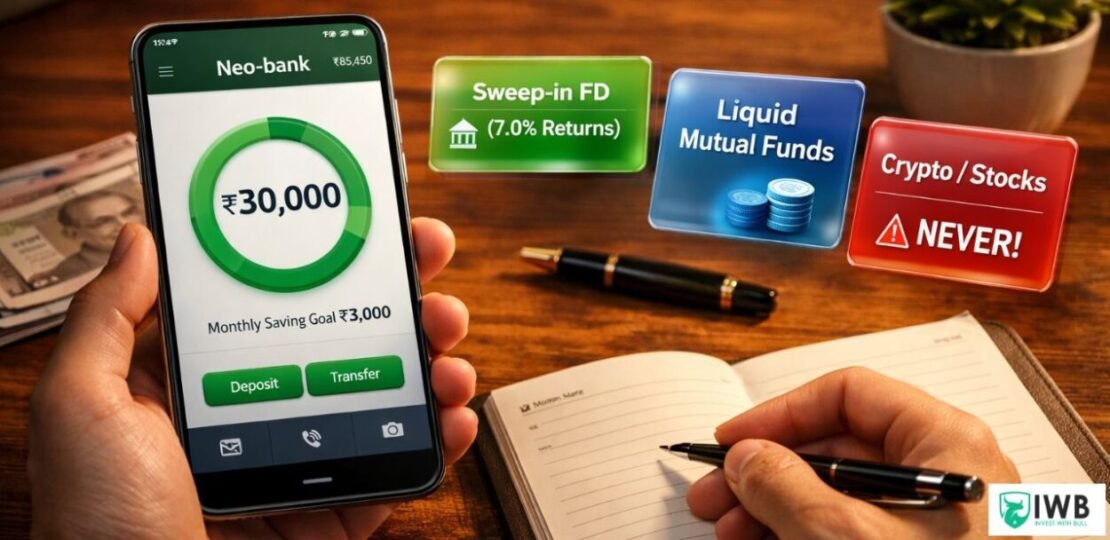

💡 Where to Park Your Cash (2026 Ratings)

Your emergency fund must be Liquid and Low-Risk.

| Option | 2026 Returns (Approx) | Access Speed | Best For |

| Sweep-in FD | 7.0% – 7.5% | Instant | The first ₹50,000 |

| Liquid Mutual Funds | 6.5% – 7.0% | 24 Hours | The bulk of your fund |

| Arbitrage Funds | 6.0% – 7.5% | 2-3 Days | Tax-efficiency for high earners |

Top Liquid Fund Picks (Jan 2026): Aditya Birla Sun Life Liquid Fund and Axis Liquid Fund are currently providing consistent 6.5%+ returns with high safety.

🔍 Google AI Search Snippet: How to Calculate Your Fund

If you’re looking for a quick answer, here is the 2026 formula for Indian households:

- Essential Expenses: Sum up your Rent + EMIs + Groceries + Insurance Premiums.

- The Multiplier: Multiply by 6 if you are salaried; multiply by 12 if you are a freelancer or business owner.

- The Medical Top-Up: Add a flat ₹50,000 to cover “non-medical” expenses that health insurance won’t pay (deductibles and consumables).

⚠️ The Golden Rules

- A “Wedding” is not an emergency. If you need a new outfit, save for it separately.

- A “Flash Sale” is not an emergency.

- Refill immediately. If you take out ₹5,000 for a bike repair, you aren’t allowed to buy a new gadget until that ₹5,000 is back in the fund.

Final Words: Cash is Your Commander

In 2026, a “diversified portfolio” won’t pay your rent when the markets are down. Cash will. Don’t wait for a better salary to start. Start with ₹500 today. Future you—the one standing in a crisis with a calm smile—will thank you.

As the Lead Analyst at Invest With Bull, Amit Sharma bridges the gap between complex banking regulations and your wallet. With a core focus on Credit Card Arbitrage and BDA Real Estate, Amit provides the data-backed analysis that salaried professionals need to maximize returns and minimize interest. He is dedicated to building financial literacy through unbiased, actionable research.

RELATED POSTS

View all